Some ten years ago, after the financial crisis 2007-2008, several thought leaders urged politicians to mainstream climate and environmental considerations into the financial recovery packages. That time, we failed, rather miserably in accelerating a green transformation of our societies. This time, with less than ten years to reach the Sustainable Development Goals of Agenda 2030, we do not have the luxury to repeat those mistakes.

The financial sector can be a major enabler and accelerator of a green and equitable transformation. Major improvements in awareness have taken place, a myriad of sustainable finance initiatives and toolkits have seen the light, with the development of various types of guidance and degrees of regulation gaining ground in the Nordics, in EU and globally. However, the speed of change is not up to the multiple challenges we are facing. We need systemic action on several fronts and all hands on deck.

From “either or” to optimal mixes of innovative voluntary action and bold regulation

Instead of remaining stuck in ideological debates of “either or” we need to develop our capacity to constantly improve and ratchet up optimal mixes of innovative voluntary action and smart regulation. The financial industry does not have the time and privilege of reinventing the concepts of the precautionary principle or the polluter pays principle. While impressive industry-driven progress has taken place e.g. through the Task Force on Climate-related Disclosure (TCFD) and the newly established Task Force for Nature-related Financial Disclosures (TNFD) aims to build awareness and help reduce the negative impacts of the financial sector on nature and biodiversity, voluntary action will simply not do the job in line with science-based policy targets. The progress achieved recently within EU on sustainable finance shows that best policy mixes are developed in cross-stakeholder partnerships but do require bold political leadership.

From toolkits to SDG finance ecosystems – the Finnish experience

Aligned with the European Green Deal ambition, only reaching the current EU 2030 climate and energy targets would require already additional investments of 260 billion EUR a year by 2030. With regards to financial resources new investments worth 2.5 trillion USD are needed in developing countries on an annual basis every year until 2030 in order to achieve the SDGs. This will not happen if we work on bits and pieces here and there.

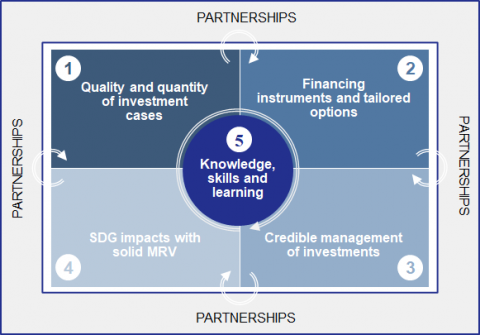

In 2018-2019 Finland, supported by Gaia Consulting, conducted pioneering work in developing a national roadmap for SDG finance. The Finnish SDG Finance Roadmap identifies five key areas for focused action. These actions can only be successfully accomplished through strong and innovative partnerships, working in ecosystems that engage public and private sector stakeholders, civil society, academia and citizens – all committed to mobilize the resources required to reach the SDGs.

Now this work is continuing, in collaboration with and supported by the European Commission, Directorate General for Structural Reform Support, in order to put those SDG finance ecosystems concretely into action in Finland, and to collect and share lessons internationally.

From thought leaders to action leaders – the Nordic experience

Nordic countries have often shown leadership in addressing global development challenges, in mobilizing climate finance, in making pioneering commitments to carbon neutrality – just a few examples of commitments also enshrined in the Nordic Vision 2030 for joint Nordic action in the 2020s. Progress will not take place at the required scale and without pioneers, without lighthouses showing the right way. The pathways to carbon neutrality can differ and should be tailored for each country. However, those pathways will never be taken without bold leadership and inclusive collaboration that leaves no one behind. The Nordic Platform for Mobilising Climate Finance, hosted during the autumn 2020 by South Pole in collaboration with Gaia, gives the floor to some of the Nordic forerunners in mobilizing private finance for climate action, as well as for greening the finance sector more broadly. Whether you are an investor, a regulator, asset manager, central bank, pension fund, NGO or researcher – in addition to a citizen eager to leave a healthy and equitable planet for your kids – feel free to join , learn from peers and share your experiences.

Climate Change, Sustainable Business Development, Sustainable Finance, Development Cooperation

mikko.halonen@gaia.fi

+358 40 700 2190